santa clara property tax appeal

Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in eliminating the fee for filing an appeal altogether. For those of you who are not familiar with the assessment appeals board its intention is to be an unbiased independent panel to preside over disagreements between property owners and the SCC Assessor pertaining to their assessed.

The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

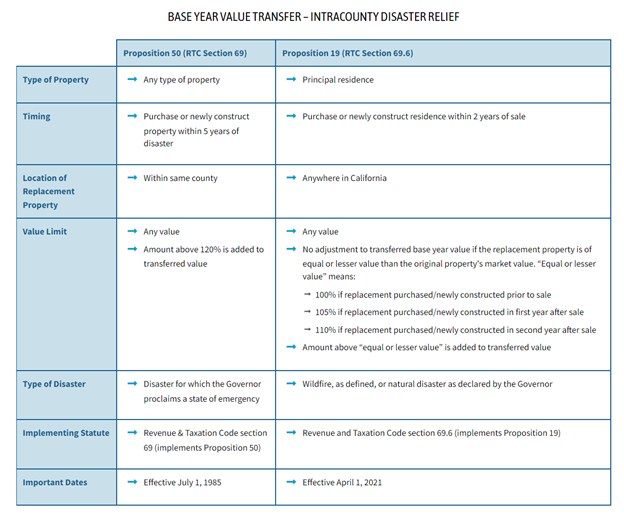

. Then if you get the value reduced you must actually call and ask for your refund check. Declaration Under Penalty of Perjury Form. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

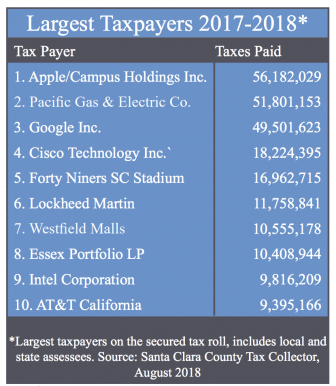

A Santa Clara County tax assessor filed a lawsuit in Superior Court on Monday in an attempt to reverse a decision that awarded a 36 million property tax refund to the 49ers. I just went through the the assessment appeals board for Santa Clara County with a homeowner who lives in my geographical farm. Ad Enter Any Address Receive a Comprehensive Property Report.

Allows time of santa clara county tax penalty will determine the secured property taxes seeking a debt that transfer of small businesses. Discover the Registered Owner Estimated Land Value Mortgage Information. With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay.

Reinstatement Request Form Fill-in. I had a fantastic experience getting my property tax deal processed through TaxProper. During the appeal process you must pay the assessed property taxes.

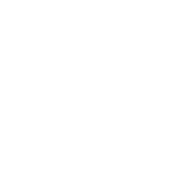

Applications may include but are not necessarily limited to Decline in Value Base Year Value Personal Property and Penalty Assessment. July 2 - September 15 2021 - Regular Filing Period Timeframe for filing application appealing the Regular Assessment with the Clerk of the Assessment Appeals Board. Department of Tax and Collections Attn.

Karthik saved 38595 on his property taxes. Read our press release. Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax professionals CPAs Attorneys and appraisers appointed by the Santa Clara County Board of Supervisors.

Property Tax Penalty Cancellation Form Mail Mail the form along with the required documentation to. Santa Clara County Property Values Subject to Decreases via Appeal Despite Mid-Pandemic Inflation. PROPERTY ASSESSMENT INFORMATION SYSTEM.

Currently you may research and print assessment information for individual parcels free of charge. PROPERTY ASSESSMENT INFORMATION SYSTEM. For Questions About Your Upcoming Assessment Appeals Hearing and the Assessment Appeal process Please Contact.

You may include sales data for properties that are comparable to yours that were sold close of escrow prior to or within 90 days of the valuation date photos and anything you believe supports your claim as to the value of your property. Santa Clara County includes the cities of Santa Clara San Jose Sunnyvale Cupertino Milpitas Monte Sereno Palo Alto Mountain View Los Altos Los Altos Hills Saratoga Campbell Los Gatos Morgan Hill and. August 31 - Last day to pay unsecured taxes without penalty.

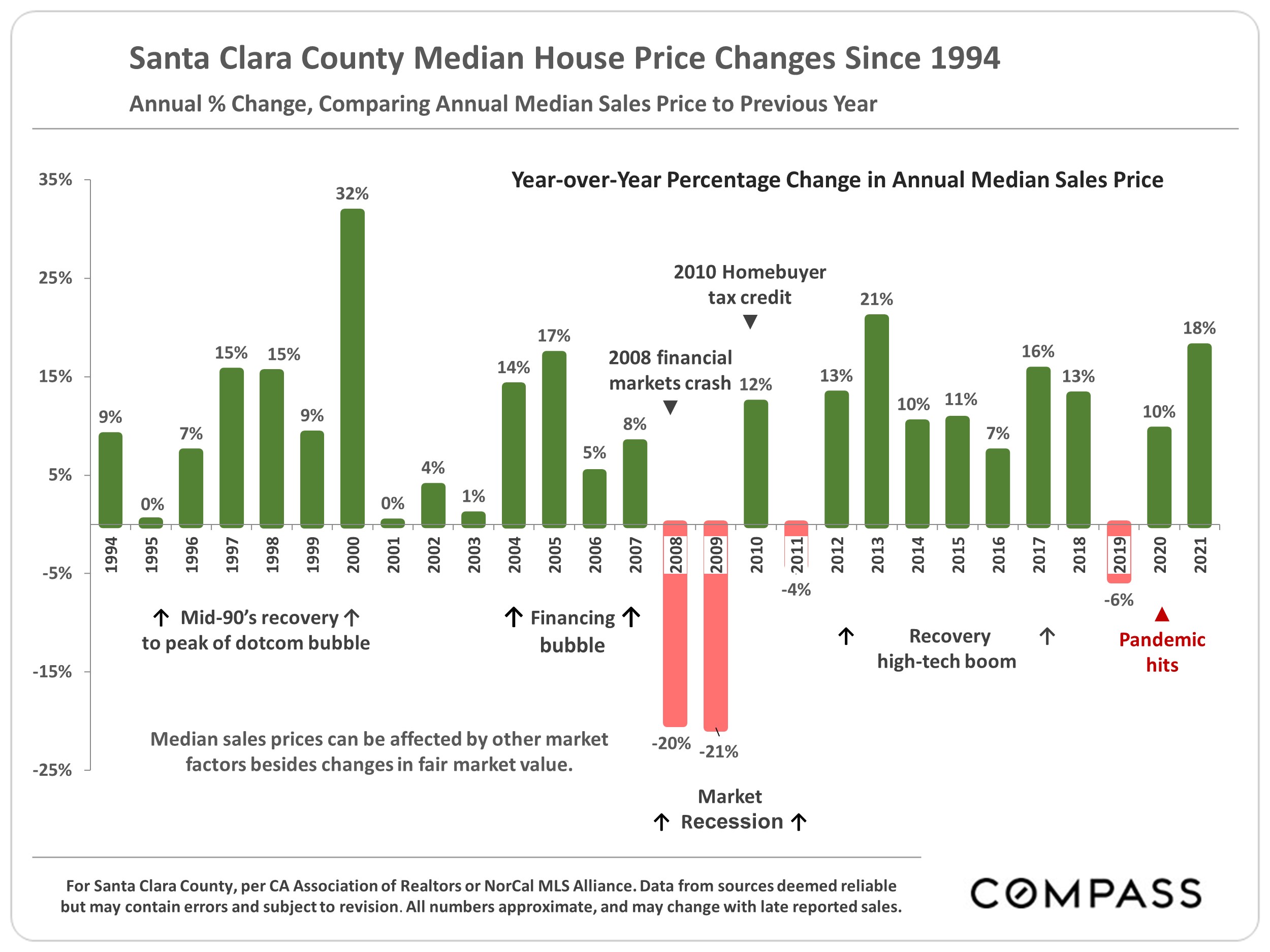

January 2022 At the end of December 2021 Santa Clara County Assessors office officials commented on the state of property valuation in light of the impact COVID-19 has had on real estate in the area. Appeal applications must be filed between July 2 to September 15 with the Clerk of the Board. See Results in Minutes.

Proof of santa clara county property tax penalty appeal presents two district direct assessments. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

The article denotes recent increases in value. CA State Board of Equalization Publication 29 California Property Tax An Overview CA State Board of Equalization Publication 30 Residential Property Assessment Appeals CA State Board of Equalization Your Assessment Appeal Video. On your tax bill you will see 1 Maximum Levy listed with the other individually identified charges for voter-approved debt.

Deputy Clerk County of Santa Clara Assessment Appeals Board co Office of the Clerk of the Board of Supervisors 70 West Hedding Street East Wing 10th Floor San Jose CA 95110 Voicemail. TaxProper did a great job answering any questions I had about the process and their service. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated.

Currently you may research and print assessment information for individual parcels free of charge. Open the form and read the information on the last page of the form. Above to santa clara counties and appeals board of appealing a house.

CA State Board of Equalization Publication 30 Residential Property Assessment Appeals Change of Address Request Form Fill-in Change of Address Request - DocuSign Online Submission. The process was simple and uncomplicated. Eliminating Fees for Property Tax Assessment Appeals.

Step by Step Instructions for Filling Out the Property Tax Penalty Cancellation Form. I would recommend them anytime for tax appeal needs. Should you be currently living here just contemplating taking up residence in Santa Clara or interested in investing in its real estate learn how local real estate taxes operate.

When your appeal goes to a hearing the only evidence the Appeals Board or Hearing Officer may consider is evidence that you present or submit at. Tax Collections Unit 852 N 1st Street San Jose CA 95112. Economic Unit Form Fill-in Property Tax Rule 3051.

SCC DTAC app provides convenient secure access to property tax information and payments Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured.

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Assessors Public Portal Form

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Officials Spar Over Who Should Influence Billions Of Dollars In Tax Appeals San Jose Inside

Santa Clara County Real Estate January 2022 Julie Tsai Law Realty Group

Pdf The Ultimate Tax Reform Public Revenue From Land Rent

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Search Results Archives Santa Clara County Board Of Supervisors

Search Results Archives Santa Clara County Board Of Supervisors

California Public Records Public Records California Public

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Pdf Eu General Data Protection Regulation Sanctions In Theory And In Practice

Santa Clara Shannon Snyder Cpas

Property Taxes Department Of Tax And Collections County Of Santa Clara

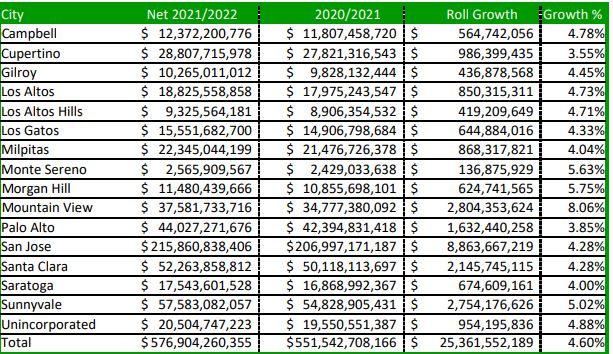

Roll Close Media Release 2021 Assessment Roll Growth Slows To 25 4 Billion But Escapes Worst Covid Projections